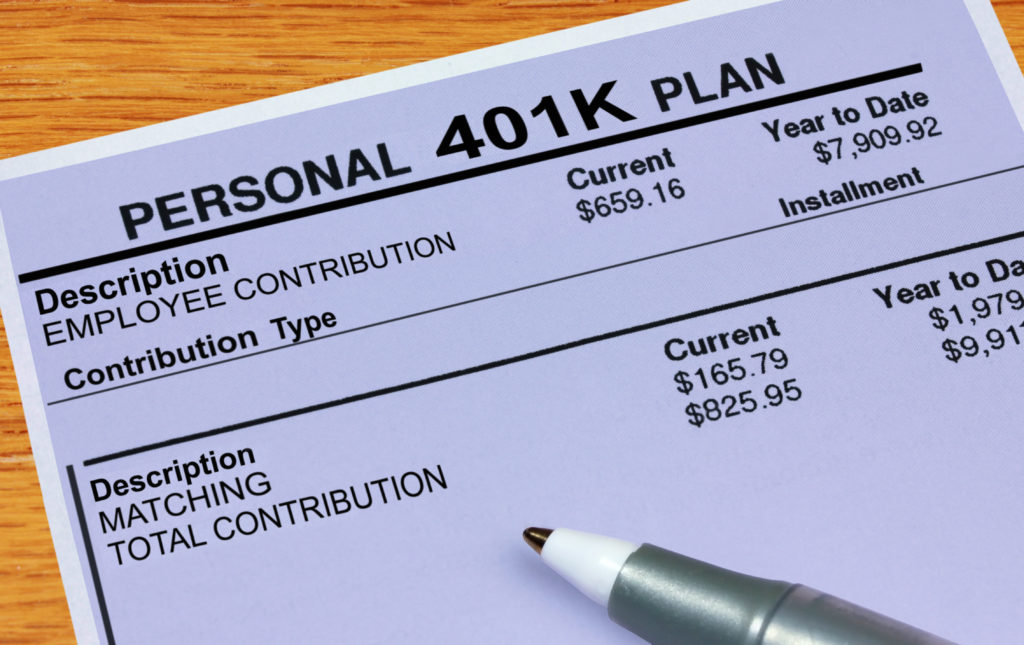

I Left My Job. What Can My Former Employer Do With My Retirement Account?

If you left a job and you’re curious what happens to the money you have invested in the company’s retirement plan, you might be surprised to learn that your former employer has several options for handling it, and which it chooses depends on the balance of your account.

If Your Balance Is Less Than $1,000

According to FINRA, the law permits your former employer to close out your retirement account if it has a balance of less than $1,000. The company can do this without contacting you for consent and they usually act quickly in these circumstances. To initiate the process, your former employer will liquidate all of the investments in your account. Once the trades settle, a check is issued for the balance, less a 20% mandatory tax withholding, which is remitted to the IRS. This is done because closing the account and sending you a check is considered a distribution, even though it was initiated by your employer.

Once you receive the check, you have two options: you can either keep the money or you have 60 days to deposit it into an IRA. The latter choice is considered an indirect rollover. Keeping the money will mean that the amount will be added to your income for the year. If the 20% amount remitted to the IRS by your former employer is less than what you owe, you’ll be required to pay additional taxes when you file. If you are under age 59 ½, the distribution will also be subject to a 10% tax penalty.

If Your Balance Was Between $1,000 and $5,000

If the balance of your account was greater than $1,000 but less than $5,000 your former employer is not legally permitted to close the account and send you a check. Instead, the IRS stipulates that it must either leave it in the company plan or transfer it to an IRA it establishes on your behalf. If your employer elects to transfer it to an IRA, it is required to notify you. The full amount of your 401K is rolled over and nothing is withheld for tax purposes because the transfer is not considered a distribution. It is common to assume that the money will remain invested throughout the transfer process, but this assumption is wrong. Prior to a rollover, employers liquidate and convert the balance of your account to cash. If this happens and you are unaware, your money will sit idle in the new IRA that was established for you and you’ll miss out on potential growth.

If Your Balance Was Greater Than $5,000

When your retirement account is greater than $5,000 it is generally left in the company plan and remains invested as it was prior to your separation. You are permitted to make changes to the investments but you cannot make new contributions. If you want to take a distribution from the account, most company plans force you to distribute the full balance. In these instances, it is best to review your rollover options. Regardless of whether the plan allows for partial distributions or not, the aforementioned 20% mandatory tax withholding will apply. This tax withholding percentage is set without regard to your individual tax situation because it ensures the Federal government receives a tax payment.

Special Considerations: Vesting & Loans

Companies often match a percentage of their employees’ salaries within a retirement plan. Some companies even contribute company stock depending on performance and years of service. These contributions are typically subject to a vesting schedule. If you leave before you are fully vested, you may forfeit the contributions made by your employer. Regardless, any money you contribute to the account is always 100% fully vested.

If you have an outstanding loan from your retirement plan, the outstanding balance comes due immediately. Usually, this means you have 90 days or less to repay the outstanding balance before it is considered a distribution. Once a loan amount is considered a distribution, the amount is counted as income and will be subject to taxation by the IRS. If you are under age 59 ½, a tax penalty of 10% will apply to the amount as well.

Conclusion

If you have questions about a retirement account you left in a former employer’s plan, please contact us today to discuss what options you have moving forward and how creating a financial plan could benefit you.