The Hive

A collection of articles from our firm about topics that matter to you

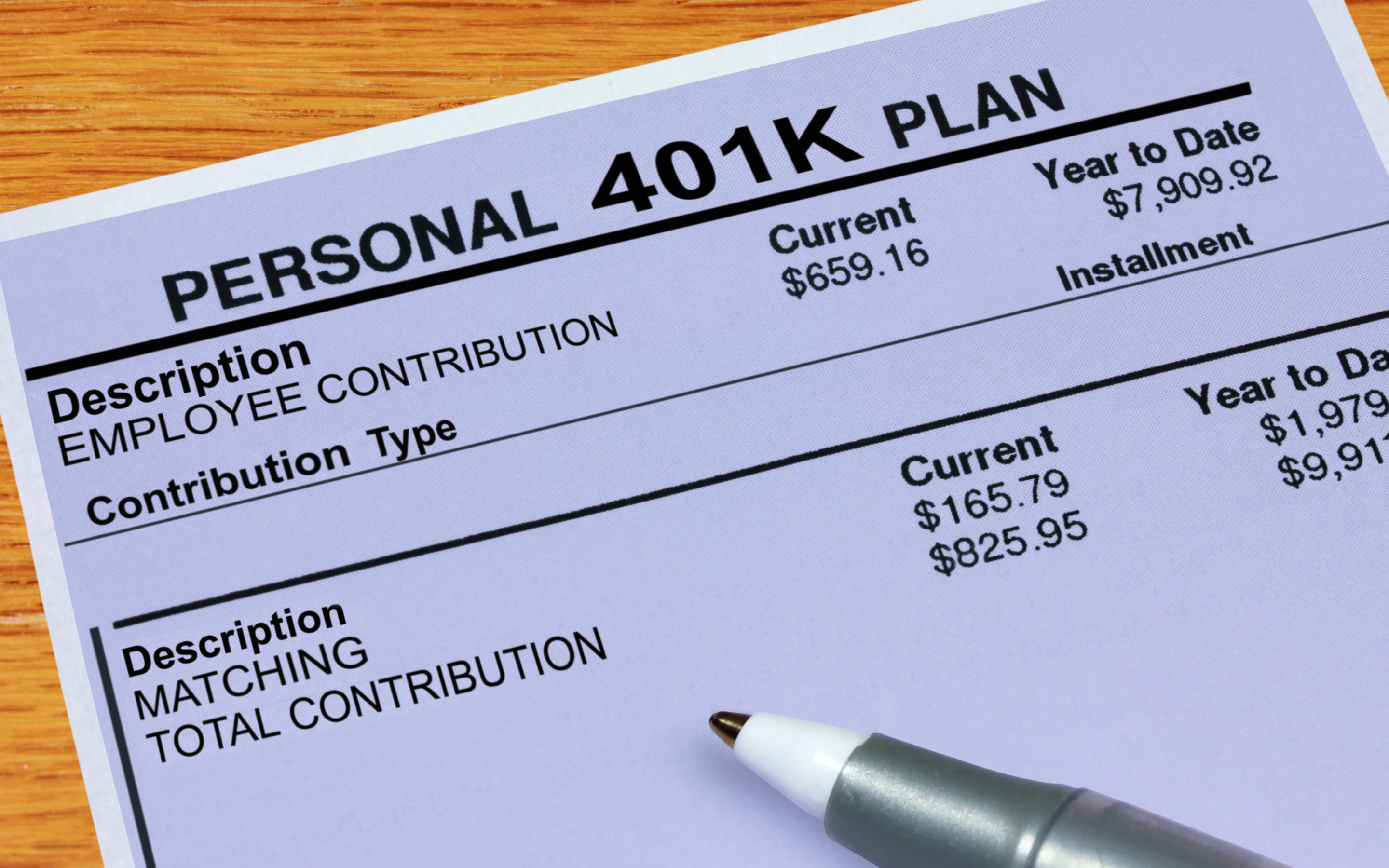

I Left My Job. What Options Do I Have With My Retirement Account?

When you leave your job, you have four (4) options to choose from with regard to your retirement account. Selecting the right option could help you avoid unforeseen tax consequences and save you money.

I Left My Job. What Can My Former Employer Do With My Retirement Account?

Before you leave your job, there are important things to consider to ensure that you maintain proper insurance coverage, have sufficient cash on hand, minimize any forfeitures, and avoid unnecessary tax consequences.

Fees – Part II: What is the impact of fees and am I getting good value for what I pay?

The fees you pay to invest and receive financial advice have a material impact on how much money you keep. In Part II of our series, learn how much of impact fees have and how you can ensure you get good value for what you pay.

Fees – Part I: What Fees Am I Paying?

Part one of a two-part series on fees. If you have an investment account, you’re paying fees, and how much may surprise you. Learn what fees you’re paying, who you’re paying them to, and how you might be able to save some money.

What Is Asset Allocation And Why It Matters

Before you leave your job, there are important things to consider to ensure that you maintain proper insurance coverage, have sufficient cash on hand, minimize any forfeitures, and avoid unnecessary tax consequences.

Things to Consider Before Changing Jobs

Before you leave your job, there are important things to consider to ensure that you maintain proper insurance coverage, have sufficient cash on hand, minimize any forfeitures, and avoid unnecessary tax consequences.

Ready to reach your financial goals?

We invite you to collaborate on how to create a financial plan that fits your personal and professional goals.

Follow us for the latest content

Honeygo Financial is a registered investment advisory firm offering services in Maryland and in other jurisdictions where exempted. All written content is for informational purposes only. Opinions expressed herein are solely those of the firm, unless otherwise specifically cited. Material presented is believed to be from reliable sources and no representations are made as to its accuracy or completeness. Tax strategies discussed herein should be reviewed by a tax professional.